After dipping below $80,000 last week, Bitcoin has seen a market recovery in the last 48 hours, climbing over 7.5% to trade above $86,000. During this rebound, crypto analyst Ali Martinez has pointed out the most crucial support level for Bitcoin at this time.

Bitcoin Confronts ‘Air Gap’ Under $83K – A Breakdown Could Be Severely Impactful

In a recent post on X, Martinez shared an intriguing observation regarding the Bitcoin market. Utilizing the UTXO Realized Price Distribution (URPD) metric based on all-time highs, he has pinpointed $83,440 as the key support zone for Bitcoin.

Typically, the URPD is an on-chain metric that illustrates the price levels where unspent transaction outputs (UTXOs) last moved, thus assessing how much Bitcoin was transacted at varying price points. Each bar in the URPD chart corresponds to a price range, while the height of the bar represents the volume of BTC traded at that price.

This makes the URPD useful for identifying possible support and resistance levels, as it indicates if a significant number of BTC were acquired or sold at a specific price level.

Martinez’s analysis, using URPD data from Glassnode, reveals that investors obtained 171,693 BTC (0.87% of the total supply) at $83,440.72, which sets this price as a robust support zone. This indicates that Bitcoin bulls are likely to step in and purchase more BTC if this level is tested again.

However, a significant ‘air gap’ exists between $72,000 and $82,000, where low levels of UTXO have been recorded. Therefore, a substantial drop below $83,440 could lead to a price decline due to the lack of demand in the immediate lower price levels.

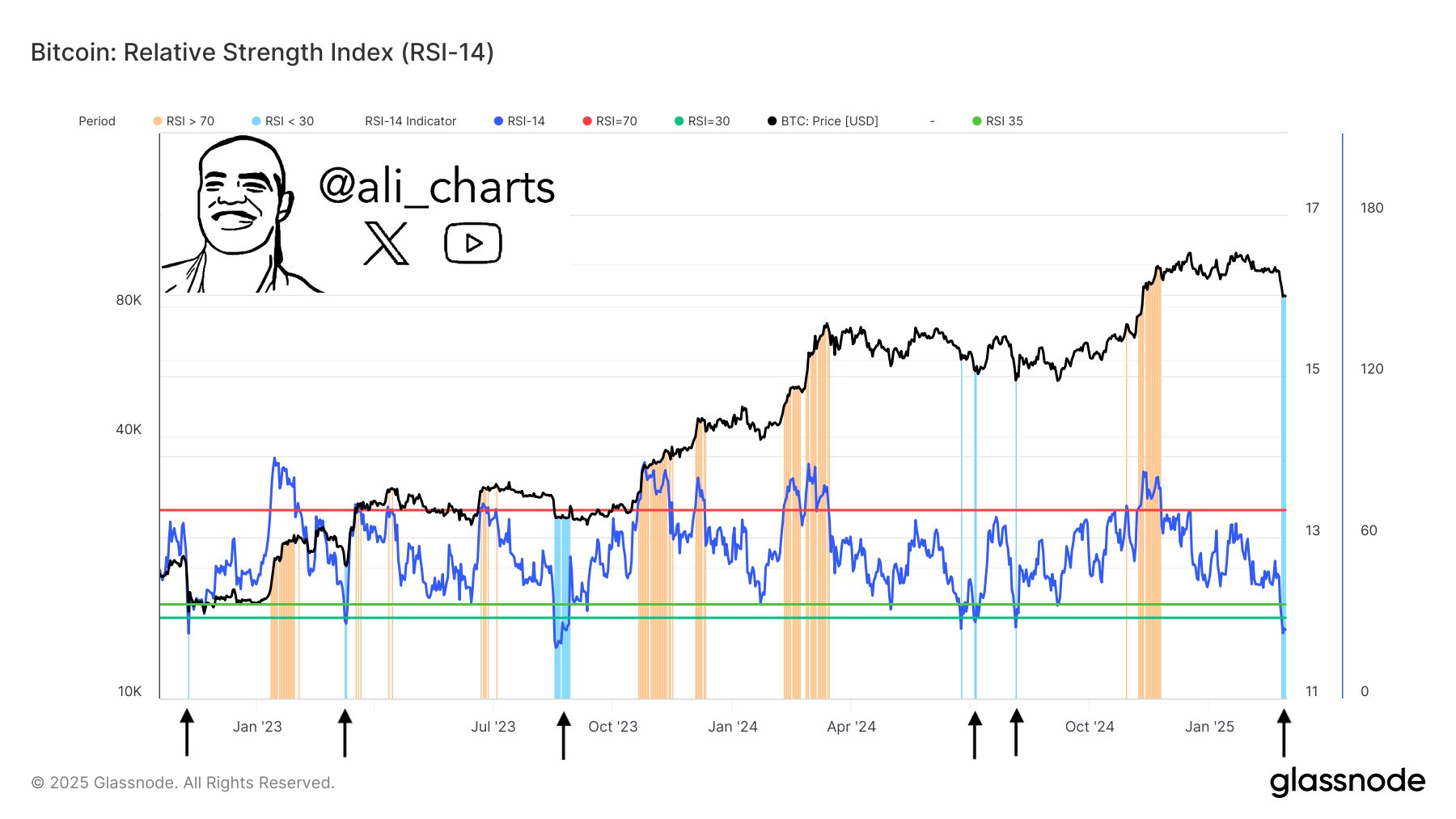

Bitcoin RSI Supports Recovery – Are More Gains on the Horizon?

In another analysis on the BTC market, Martinez suggested the possibility of additional price gains during the current recovery. He noted that Bitcoin has historically experienced a price rebound after its Relative Strength Index (RSI) drops below 30.

The RSI gauges the momentum of price changes to determine if an asset is overbought (above 70) or oversold (below 30). According to Martinez, Bitcoin’s RSI recently touched 24 in the oversold range, indicating that a rebound towards previous high price levels may be forthcoming based on historical patterns.

At the time of writing, Bitcoin is trading at $86,383, reflecting a 2.32% increase in the last 24 hours. Despite the recent price correction, BTC remains 21.02% lower than its all-time peak of $109,114.

Featured image from iStock, chart from Tradingview