Crypto analyst Ali Martinez has provided noteworthy insights into the present Bitcoin (BTC) market using the UTXO Realized Price Distribution (URPD) metric. This established market authority has pinpointed critical support and resistance levels that could significantly influence BTC’s short-term price trajectory.

After dealing with another week of substantial market volatility, Bitcoin prices remain in a consolidation phase, struggling to make an effective breakout above $84,380.

Bitcoin Bull Run: $97,532 Is Crucial for Reestablishing Bullish Momentum

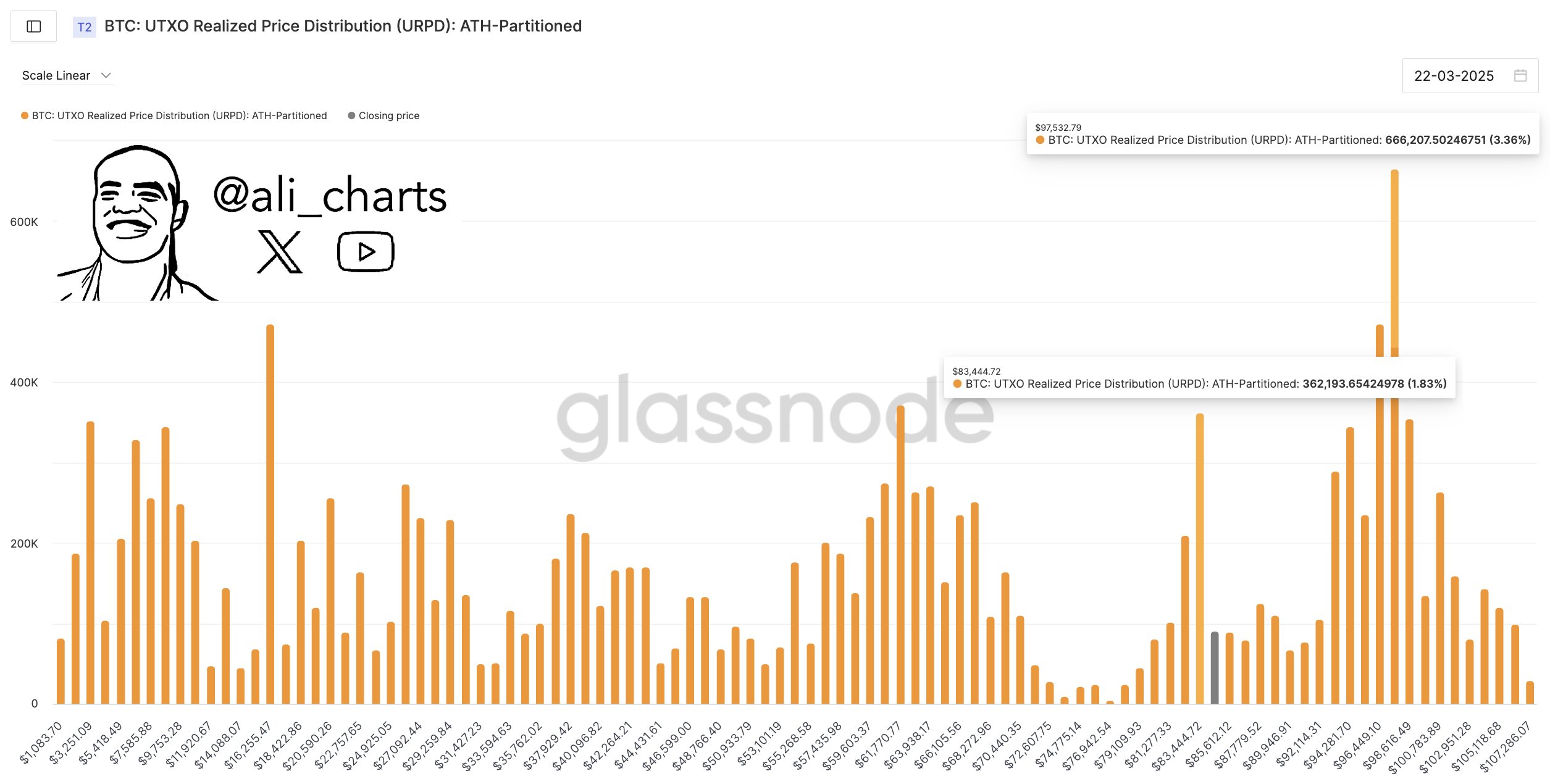

In on-chain analysis, the Unspent Transaction Output (UTXO) reflects Bitcoin remaining after each transaction, which can subsequently be used as input for new transactions. Consequently, the UTXO Realized Price Distribution assists analysts in identifying price levels where Bitcoin’s current supply was last transacted. By identifying price areas with significant UTXO clusters, the URPD becomes an essential gauge for determining resistance and support levels.

In a post on March 22, Martinez shared that data from Glassnode reveals a strong UTXO cluster around $83,444, indicating that many investors have their cost basis centered at this price point. Presently, BTC’s price hovers above this support level, suggesting a potential upward trend. However, Martinez notes that a formidable resistance barrier exists for market bulls at the $97,532 level, where a significant number of UTXOs are also located.

The analyst notes that successfully breaking through this resistance level could indicate a renewed bullish momentum in a BTC market that has seen considerable corrections recently. In an optimistic scenario, Bitcoin may surge toward new all-time highs. Conversely, failing to surpass $97,532 could result in BTC remaining within a consolidation phase or even retracing to lower support levels.

Is Bitcoin Set to Resume Its Uptrend?

In other news, Martinez has indicated that Bitcoin’s ongoing correction might still be in process, as suggested by the Bitcoin Sharpe Ratio. For context, the Sharpe Ratio gauges whether BTC’s returns are currently compensating for the level of risk involved.

The analyst further explains that optimal market entry points have typically occurred when the Bitcoin Sharpe Ratio indicates low risk, presenting a prime buying opportunity. However, the current Sharpe Ratio reflects a high-risk environment, suggesting that potential BTC investors may need to be patient.

Martinez stated:

We’re not there yet, but getting close might signal a prime buying window!

As of this writing, BTC is trading at $84,075 following a 0.27% increase over the last 24 hours. Nonetheless, the daily trading volume has plummeted by 46.41% due to declining market engagement.

Featured image from MorningStar, chart from Tradingview

Editorial Process for bitcoinist focuses on providing thoroughly vetted, accurate, and impartial content. We adhere to rigorous sourcing standards, and every piece is meticulously reviewed by our team of top technology specialists and experienced editors. This approach ensures the reliability, relevance, and quality of our content for our audience.