Recent on-chain data indicates that the largest Bitcoin holders have gradually resumed buying, while other market participants have continued to distribute their holdings.

Initial Signs of a Shift in the Bitcoin Accumulation Trend Score

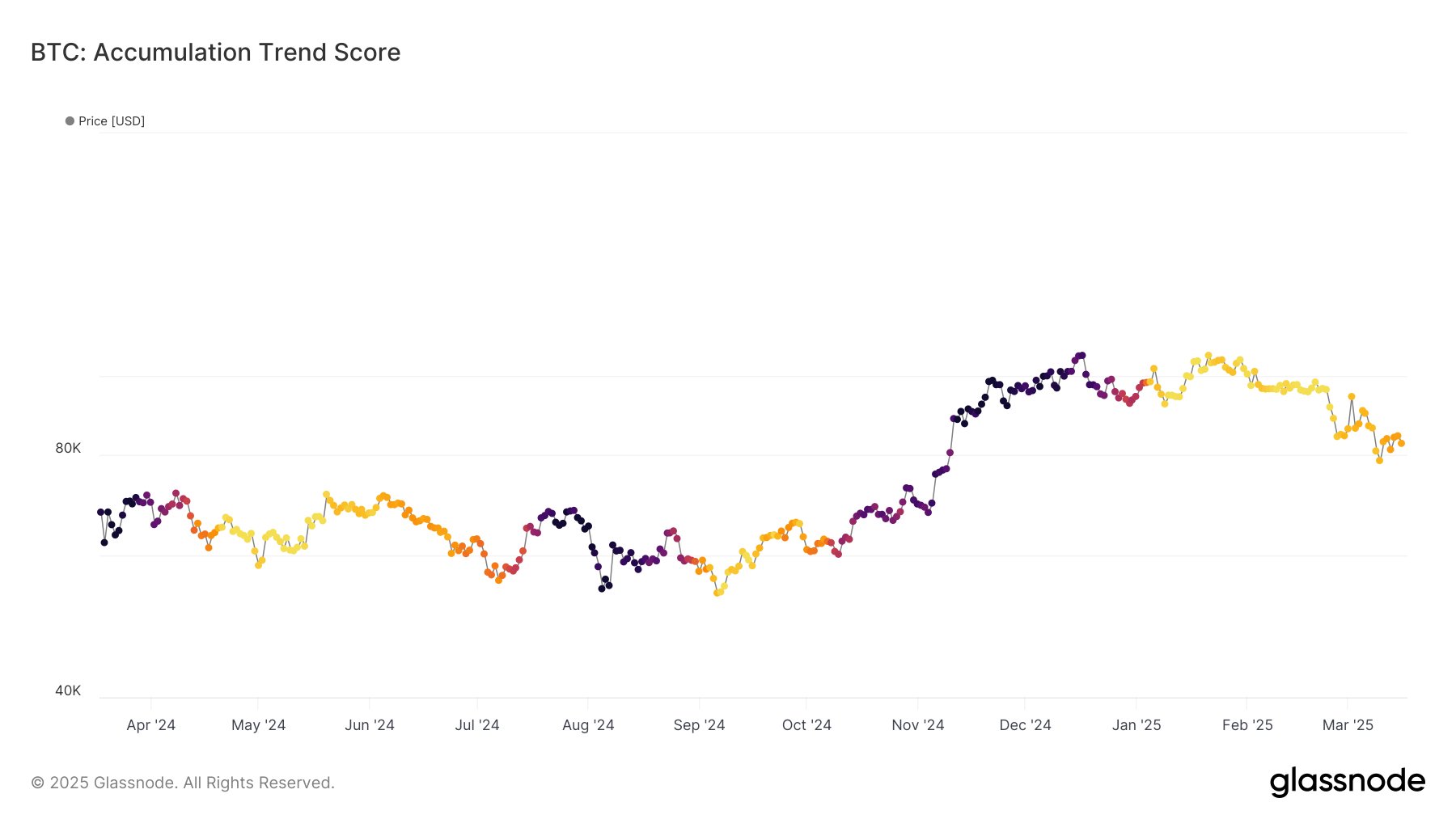

In a recent update on X, on-chain analytics firm Glassnode discussed the recent shifts in the Bitcoin Accumulation Trend Score. This metric serves as an indicator to determine whether Bitcoin investors are in an accumulation phase.

The scoring relies on balance fluctuations in investors’ wallets to make this assessment. Furthermore, it considers the scale of accumulation or distribution in relation to the wallet sizes involved, giving greater weight to large investors’ actions.

A score nearing 1 indicates that large holders (or many small investors) are actively accumulating, while a score close to 0 suggests a distribution phase or a lack of accumulation activity.

Here is the chart provided by Glassnode that illustrates the trend in the Bitcoin Accumulation Trend Score over the past year:

Investors appear to have been distributing for a while now | Source: Glassnode on X

The chart illustrates that darker shades represent accumulation, while lighter shades denote distribution. Notably, the metric displayed a dark color during the rally observed in the latter months of 2024, suggesting a surge in accumulation.

This year, however, the trend has reversed, with the indicator reaching a lighter shade and a value near zero. Given this distribution trend among large holders, it’s understandable why Bitcoin has encountered bearish price action.

Interestingly, the indicator has recently shown an uptick, now exceeding the 0.1 threshold. This may indicate that some buying is occurring at current lower prices. As noted by Glassnode, “While distribution remains prevalent, this shift suggests preliminary signs of accumulation.”

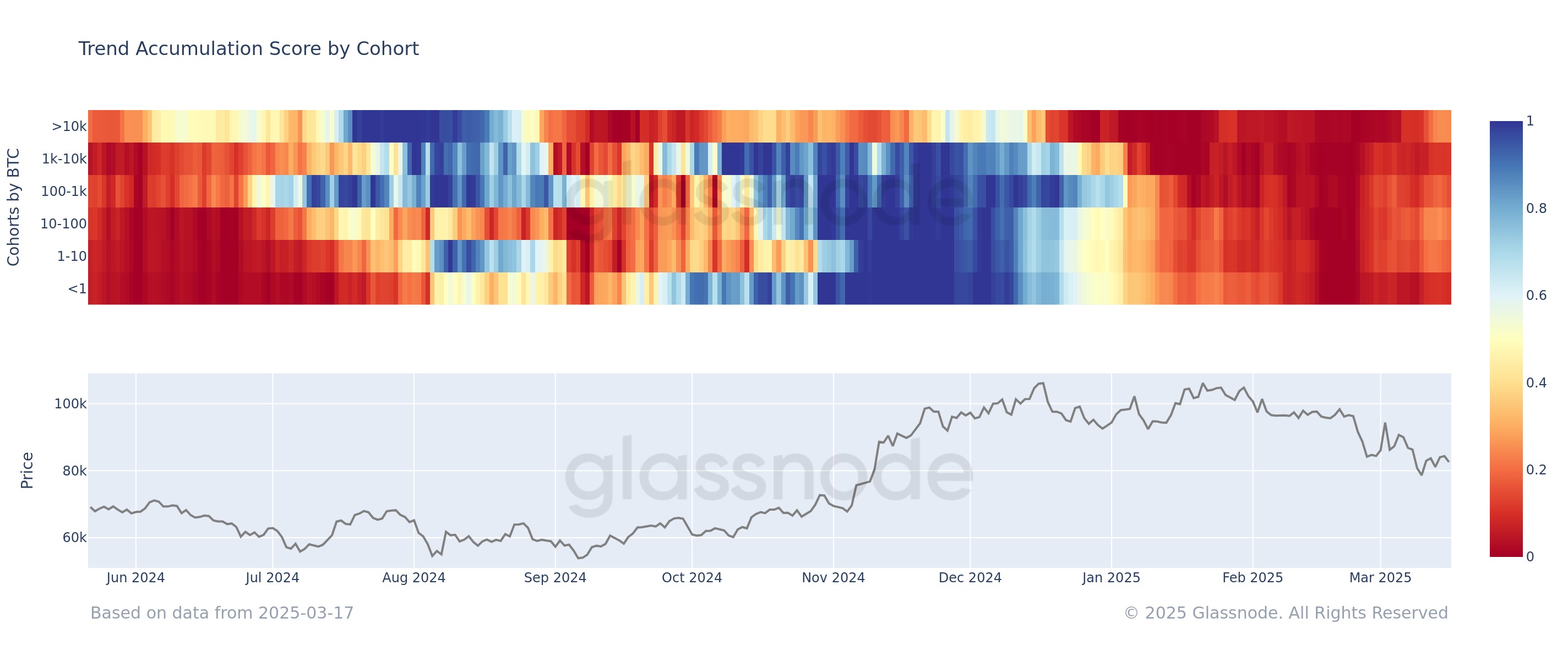

As previously outlined, the Bitcoin Accumulation Trend Score prioritizes larger entities, which can obscure the activities of smaller investors. Therefore, here’s an alternative version of the indicator that reflects the metric’s value across different trader categories:

Behavior across the groups seems inconsistent at present | Source: Glassnode on X

The graph reveals that the largest Bitcoin holders, those possessing over 10,000 BTC, have recently seen a rise in their metric value, suggesting a gradual shift towards buying.

Conversely, while these mega whales have demonstrated this buying trend, those classified as whales (holding between 1,000 and 10,000 BTC) have continued to engage in significant distribution. Meanwhile, the smallest investors, referred to as “shrimps” (holding less than 1 BTC), have mirrored the whale activity by selling.

As explained by Glassnode,

This trend indicates that while overall sell pressure continues, some large entities are beginning to absorb Bitcoin supply. Whether this signifies a turning point or merely a temporary respite in distribution remains to be determined.

BTC Price Overview

Following recent volatility, Bitcoin’s price has stabilized around the $84,000 mark.

BTC price movement over the past five days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist prioritizes delivering well-researched, accurate, and impartial content. We adhere to rigorous sourcing standards, and every page is thoroughly reviewed by our team of top technology experts and experienced editors. This ensures the integrity, relevance, and value of our content for our readers.