Following a challenging start to the week, Bitcoin’s price seems to be stabilizing and gaining some bullish traction. On Friday, March 14, this leading cryptocurrency showcased its emerging momentum, steadily ascending the charts and briefly surpassing the $85,000 threshold as the week concluded.

Notably, Bitcoin’s open interest (OI) has been rising in tandem with its price in recent days. With open interest increasing, a key question arises — is the Bitcoin bull run back on course?

Bitcoin Open Interest Rises to $27.9 Billion — What Does It Indicate?

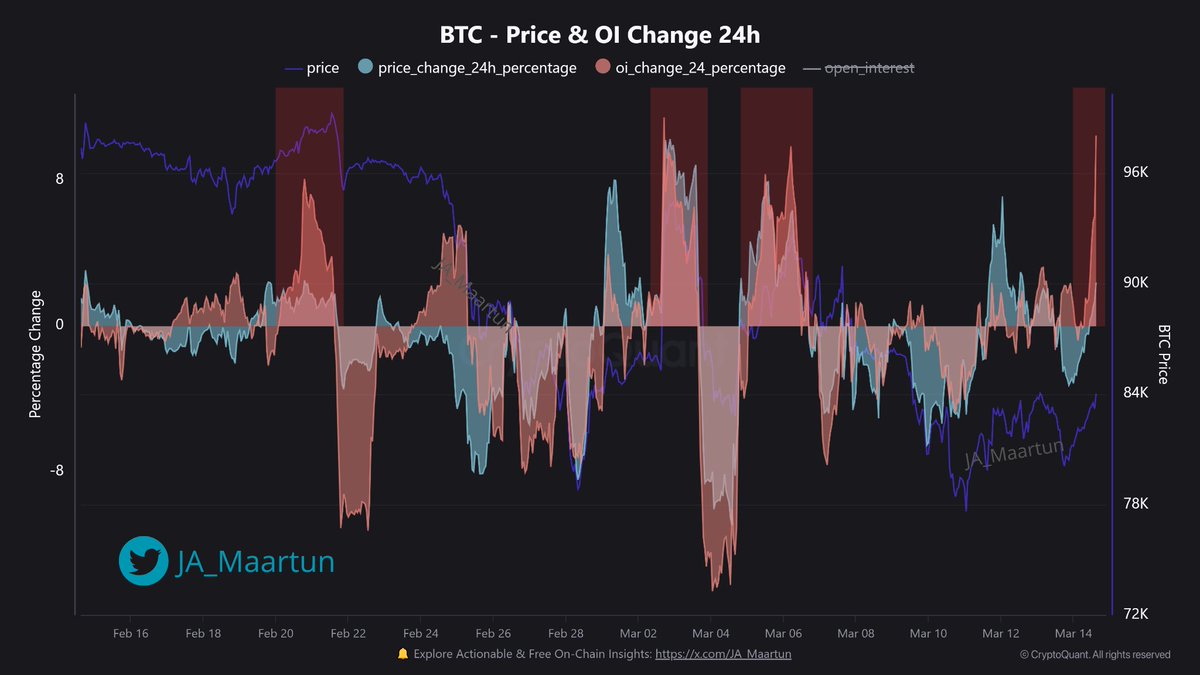

In a recent update on the X platform, a community analyst from CryptoQuant, known as Maartunn, highlighted that Bitcoin’s open interest is on the rise. Open interest serves as a measure of the total capital invested in BTC derivatives at any given moment.

Data from CryptoQuant reveals that Bitcoin’s OI experienced a significant increase on Friday, reaching $27.9 billion. Maartunn pointed out that this major uptick signifies over a 13% rise (exceeding $3.3 billion) from the most recent low.

Source: @JA_Maartun

Typically, a rise in Bitcoin open interest suggests that investors are establishing new positions in the futures and options markets, indicating an influx of capital into BTC derivatives. Conversely, a decline in OI suggests that derivatives traders may be exiting their positions or being liquidated.

An uptick in open interest can be a favorable indicator for the leading cryptocurrency, especially considering historical trends. The influx of new capital often points to a positive investor sentiment (usually confidence) or speculation on Bitcoin’s price direction.

As more investors engage in the derivatives market and place their bets on Bitcoin’s price, the increased open interest could heighten market volatility. This surge in volatility may signal that Bitcoin is poised for significant price fluctuations soon.

What’s Next for Bitcoin Price?

BTC’s price seems ready for a substantial upward move. Chartered Market Technician Tony Severino noted on the X platform that the market leader could target around $95,000 in the coming days.

Source: @tonythebullBTC

The crypto expert emphasized that this forecast depends on Bitcoin’s price successfully reclaiming the 200-day moving average (MA). A decisive close above this MA could propel the price toward the 50-day MA, situated around the mid-$90,000 area.

At the time of this writing, Bitcoin’s price is approximately $84,500, reflecting an almost 5% increase over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by DALL-E, chart from TradingView

Editorial Process for Bitcoinist is focused on delivering well-researched, accurate, and impartial content. We adhere to stringent sourcing standards, and each article is carefully reviewed by our team of top technology experts and experienced editors. This process guarantees the integrity, relevance, and value of our content for our audience.