Over the past week, Bitcoin’s price has remained within the $81,000 to $86,000 consolidation range, indicating significant indecision between bullish and bearish sentiments. While many on-chain metrics suggest a bearish outlook for the leading cryptocurrency, recent data hints that the bull run may not be finished just yet.

BTC Investors Are Not in a State of Full Panic: Insights from Blockchain Firm

In a recent update on the X platform, blockchain analytics company Glassnode highlighted that a specific group of Bitcoin holders, known as “short-term holders” (STH), are experiencing escalating market pressure. This observation is drawn from the unrealized losses of this group of investors.

To clarify, an unrealized loss is one that exists on paper; the investor continues to hold and has not sold the asset despite its declining value. A loss becomes “real” only when the holder sells the asset for less than the original purchase price.

According to Glassnode, the unrealized losses for Bitcoin investors have been increasing recently, particularly pushing the short-term holders towards a significant +2σ threshold. The STH Relative Unrealized Loss metric hitting this extreme +2σ level has historically correlated with rising selling pressure.

However, Glassnode pointed out that the size of the STH losses still remains within the range typically associated with a bull market. In fact, the magnitude of these losses is minor compared to the market-wide sell-off experienced in 2021, suggesting that the bull cycle may still have life in it.

Source: @glassnode on X

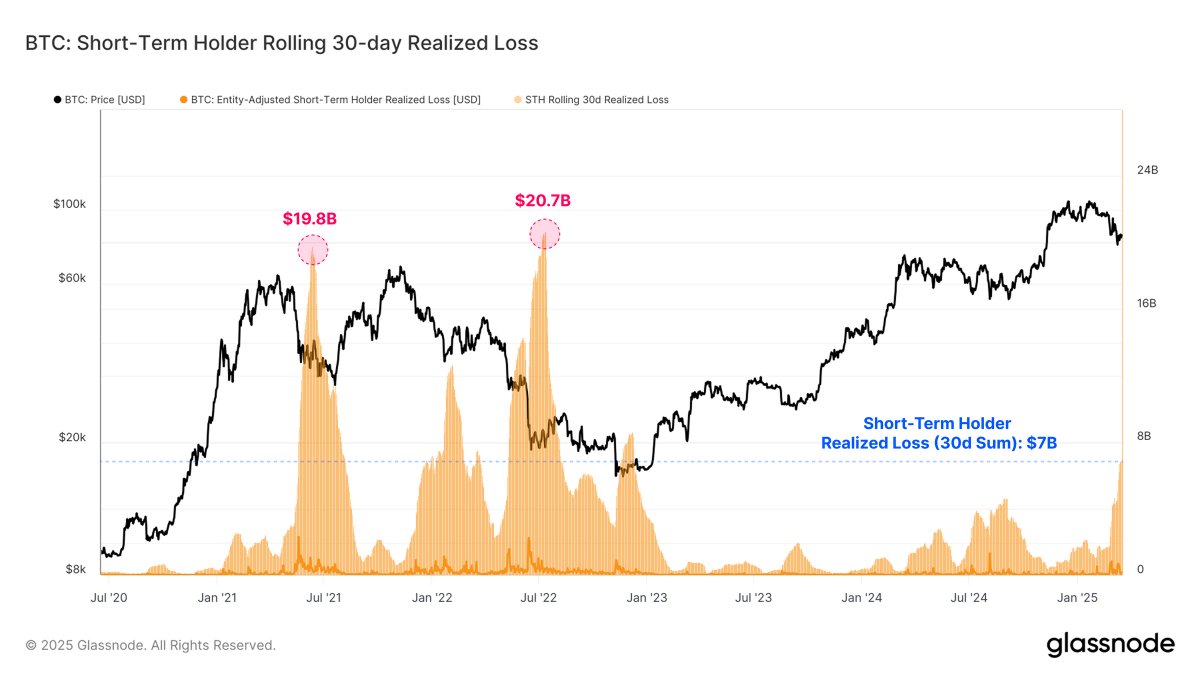

Moreover, Glassnode revealed that the rolling 30-day realized losses for Bitcoin’s short-term holders have now exceeded $7 billion, marking the largest sustained loss event in the current cycle. Despite this significant figure, it remains considerably less severe than the capitulation events observed at the onset of previous bear markets.

For instance, during major price corrections in May 2021 and 2022, Bitcoin’s realized losses soared to approximately $19.8 billion and $20.7 billion, respectively. Given that the realized losses currently remain well below those capitulatory events, there is a possibility that the market has yet to reach a full-blown panic state.

Bitcoin Price Overview

At the time of this writing, Bitcoin’s price is approximately $84,300, reflecting a 0.3% increase over the last 24 hours. Data from CoinGecko indicates that the flagship cryptocurrency has seen a minor decline of just 0.6% over the past week, underscoring the market’s current volatility.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist focuses on providing thoroughly researched, accurate, and impartial content. We adhere to rigorous sourcing standards, and each piece is meticulously reviewed by our team of leading technology experts and veteran editors. This process ensures the integrity, relevance, and value of our content for our readers.