Recent data indicates that Bitcoin has experienced a surge in futures trading volume, distancing itself from Ethereum (ETH) and Solana (SOL).

Recent Rebound in Bitcoin Futures Volume

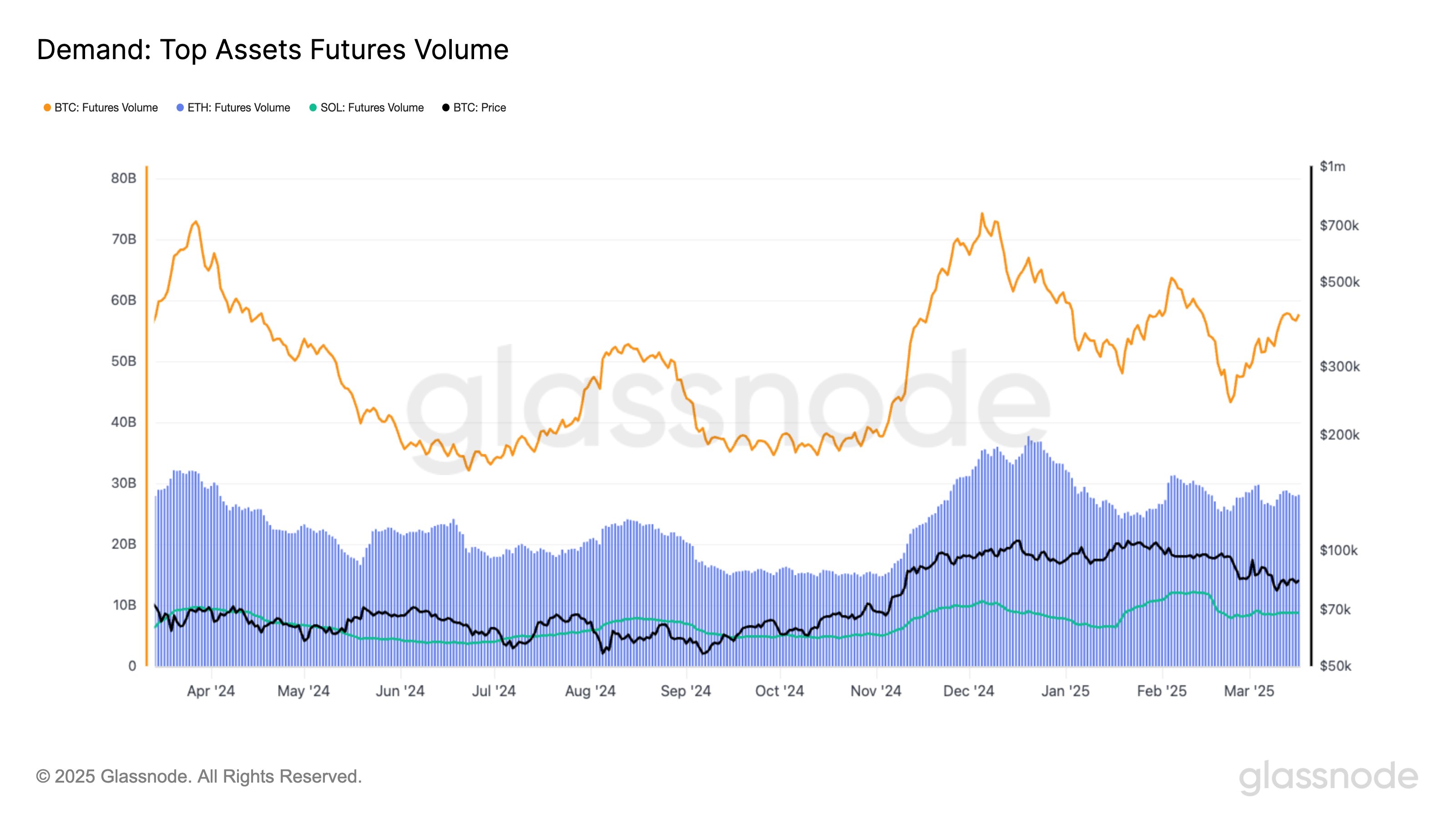

In a recent update on X, the on-chain analytics company Glassnode has discussed the current trend in futures trading volume for Bitcoin and two other major cryptocurrencies.

The term “futures trading volume” refers to a metric that tracks the total volume of a specific cryptocurrency engaged in futures trades on centralized derivatives exchanges.

Initially, here’s a chart highlighting the futures trading volume of Bitcoin:

The metric appears to be on the rise for BTC in recent days | Source: Glassnode on X

The chart above shows that BTC futures trading volume declined last month, but it has recently rebounded. At its lowest point, the volume dipped near $40 billion but has since recovered to $57 billion.

“Bitcoin Futures volume began the year at $60B, peaked at $63B YTD, and is now at $57B – up 32% since February 23, but still below December’s peak of $74B,” the analytics firm noted.

While the leading cryptocurrency has seen a recent increase in this metric, Ethereum and Solana have not shared the same fate. The chart shows a relatively stable trend for these two altcoins.

The trend in ETH futures trading volume over the past year | Source: Glassnode on X

The Ethereum futures volume was approximately $32 billion at the beginning of the year and currently stands at $28 billion, showing minimal change. Similarly, Solana’s indicator started at $7 billion and has only climbed to $8.7 billion, reflecting a small adjustment.

The metric has also shown little movement for SOL | Source: Glassnode on X

The futures trading volume provides insight into the speculative interest surrounding a cryptocurrency. The recent trend suggests that Bitcoin is capturing investor attention, while altcoins remain relatively stagnant.

In other updates, the market intelligence platform IntoTheBlock has reported on X that Bitcoin long-term holders have started to increase their supply lately.

The analytics company defines “long-term holders” as those who have maintained their coins for over a year without any transfers or sales.

BTC HODLers have recently seen a change in their supply | Source: IntoTheBlock on X

According to IntoTheBlock, long-term holders typically accumulate during bearish markets, so this recent shift could indicate a change in sentiment towards bearishness. However, the analytics firm cautions that “this isn’t always a dependable signal: for instance, in mid-2021, similar accumulation did not lead to a prolonged downturn.”

Current BTC Price

As of this writing, Bitcoin is trading at around $81,800, having decreased by more than 3% in the last 24 hours.

The price of the coin appears to have retraced its gains | Source: BTCUSDT on TradingView

Featured image from Dall-E, IntoTheBlock.com, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist focuses on delivering well-researched, precise, and impartial content. We maintain rigorous sourcing standards, and every page undergoes careful review by our team of leading technology experts and experienced editors. This process guarantees the integrity, relevance, and quality of our content for our audience.