A cryptocurrency whale known for successful trading strategies has emerged victorious after establishing a substantial short position on Bitcoin (BTC).

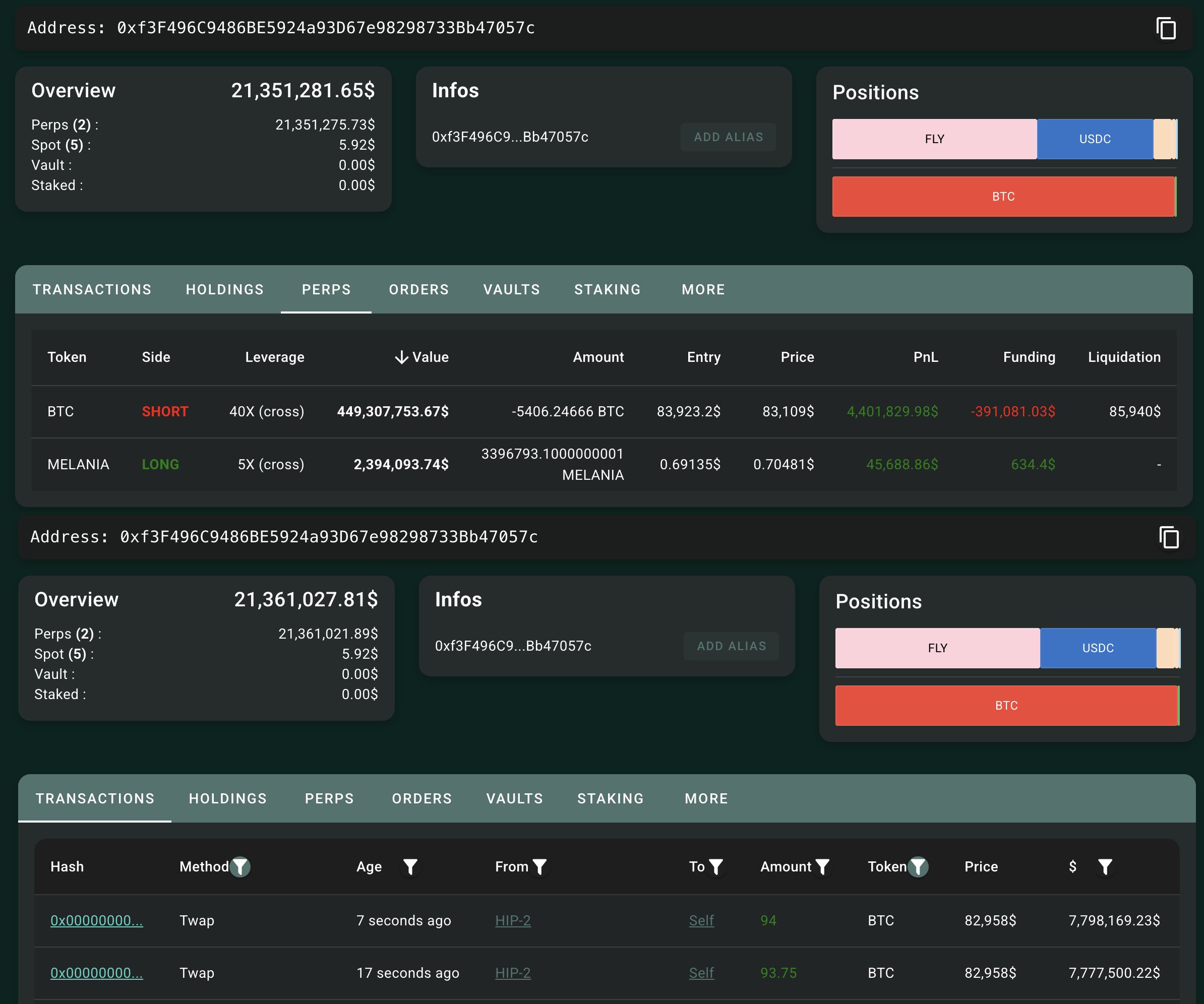

According to blockchain analytics company Lookonchain, this affluent trader accumulated a 3,940 BTC short position valued at $332 million, utilizing leverage as high as 40x.

Short-selling involves borrowing an asset from an exchange or broker with the intention of selling it, aiming to repurchase it at a lower price to secure the difference as profit.

Lookonchain reports that the whale initially faced unrealized losses exceeding $1 million.

“Entry price: $84,040.8

Liquidation price: $85,300.”

In addition to navigating fluctuating prices, the whale faced challenges from a group of traders who attempted to raise Bitcoin’s price to liquidate this investor’s large short position.

“[A pseudonymous trader] organized a team to pursue this whale who shorted BTC with 40x leverage.

Within an hour, the team had driven BTC prices above $84,690 in a brief time frame.”

Lookonchain highlights that the whale avoided liquidation by adding $5 million in USDC stablecoins to their account.

“The whale continued to enhance their short position on BTC.

At present, they are realizing profits from closing positions using TWAP (time-weighted average price).

They currently hold a position of 5,406 BTC ($449 million) with an unrealized profit of $4.4 million.”

When dealing with leverage, traders can increase their accounts with additional funds and collateral, thereby pushing their liquidation price farther from their entry price. While this strategy lowers the chances of liquidation, it also heightens the potential for larger losses if the asset moves unfavorably against their position.

Lookonchain has been closely monitoring this whale, noting a 100% success rate over one month, amassing profits of $16.39 million.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to receive email alerts directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should conduct their own research before making any high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Be aware that your transactions and trades are at your own risk, and any losses incurred are your responsibility. The Daily Hodl does not endorse the buying or selling of any cryptocurrencies or digital assets, nor does it serve as an investment advisor. Additionally, The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney