Macro expert and Real Vision CEO Raoul Pal asserts that Bitcoin (BTC) and other major altcoins are showing strong performance despite fluctuations in the crypto markets.

In a recent discussion on the social media platform X, the former Goldman Sachs executive mentions that Bitcoin, Ethereum (ETH), Solana (SOL), and Sui (SUI) are forming bullish patterns on their higher time frame charts.

“We find ourselves in the midst of the most significant macro trade ever. All the market fluctuations and timeline FUD (fear, uncertainty, and doubt) are merely distractions. To seize this opportunity, it’s essential not to be overly exposed on the risk spectrum, refrain from using leverage, and maintain patience while keeping a broader perspective.”

Pal indicates that Bitcoin is on a bullish trajectory in the weekly chart, successfully consolidating well above the trendline that connects its previous all-time highs in the $60,000 range.

“It’s perplexing and unfortunate to witness so much bearish sentiment and anxiety in crypto when BTC appears this strong. Please take a step back and review the bigger picture.”

Currently, Bitcoin is priced at $95,444, reflecting a 1.7% decrease in the past 24 hours.

Next, Pal notes that ETH is forming a bullish triangle pattern on the weekly chart, positioned for a potential breakout after rebounding off the lower trendline near the $2,600 mark.

“When ETH looks like this, please expand your view.”

As of now, ETH is trading at $2,737, up 1.4% in the last 24 hours.

He further shares a weekly chart of Solana, indicating that SOL is still in an upward trend and could be preparing to reclaim the $200 level as support.

“When SOL looks like this, please broaden your perspective.”

SOL is currently valued at $179, experiencing a 6.1% increase in the last 24 hours.

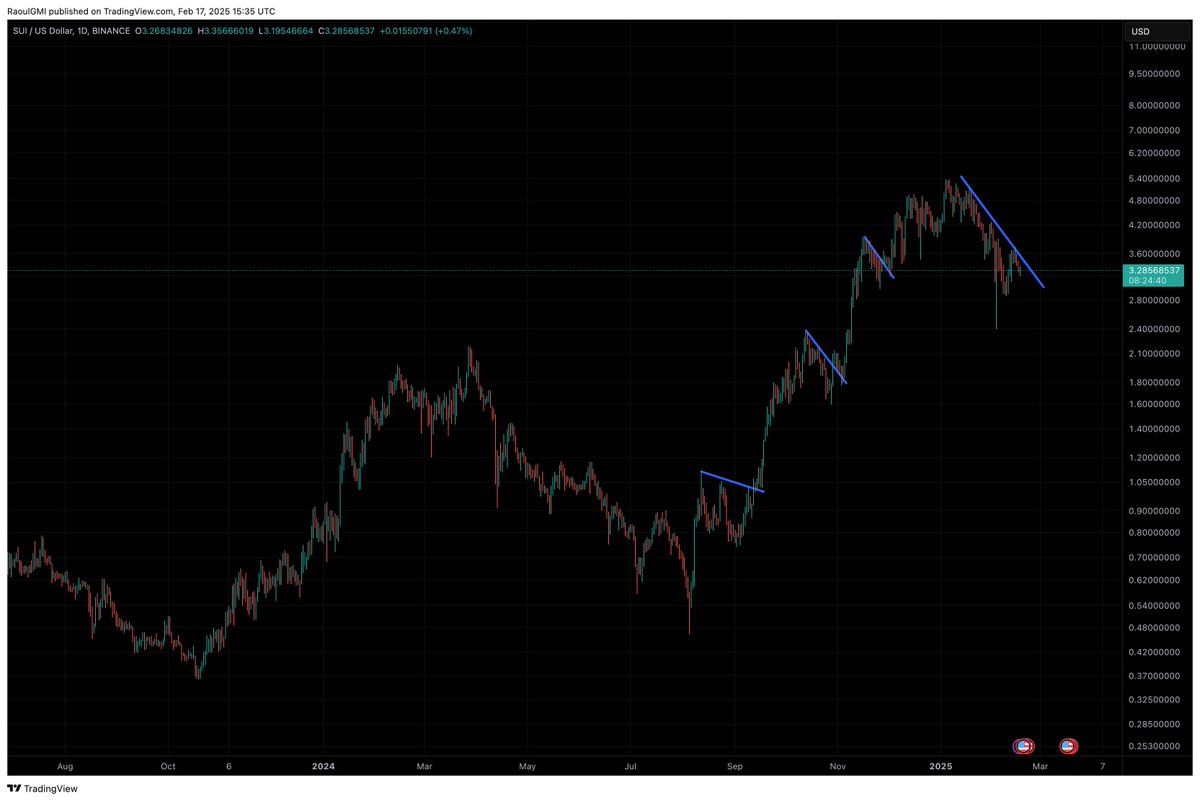

Lastly, he suggests that Sui is set to repeat a historical pattern by overcoming the resistance of a descending trendline and establishing new all-time highs.

“When Sui appears like this, please take a moment to look at the bigger picture.”

SUI is trading at $3.19, down 3.8% in the last 24 hours.

Bill Barhydt, CEO of crypto services company Abra, shares a similarly optimistic outlook for BTC, ETH, SOL, and SUI.

He believes that economic strategies under former US President Donald Trump could inject significant liquidity into the markets, propelling crypto assets to unprecedented values.

“My base case for the ongoing crypto cycle:

- Bitcoin: $350,000.

- Ethereum: $8,000.

- Solana: $900.

- Sui: $25.

Stay Updated – Subscribe to receive email alerts directly to your inbox

Check Market Trends

Follow us on X, Facebook, and Telegram

Explore The Daily Hodl Mix

Disclaimer: The views expressed at The Daily Hodl are not investment advice. Investors are encouraged to conduct their own research before making any high-risk investments in Bitcoin, cryptocurrency, or digital assets. Please be aware that your trades and transactions are at your own risk, and any potential losses are your own responsibility. The Daily Hodl does not endorse the buying or selling of any cryptocurrencies or digital assets, nor does it act as an investment adviser. The Daily Hodl also participates in affiliate marketing.

Generated Image: DALLE-3