The co-founders of the crypto analytics platform Glassnode assert that for Bitcoin (BTC) to enter a significant uptrend, certain key metrics must converge.

Jan Happel and Yann Allemann, collectively known as Negentropic, inform their 63,100 followers on the social media platform X that historical trends indicate three crucial factors must align for Bitcoin to embark on a prolonged bull run.

The analysts highlight the Bitcoin Risk Signal as a vital component, which assesses the likelihood of BTC facing a major price downturn. According to Glassnode, this signal “is founded on a collection of proprietary indicators, including bitcoin price data, on-chain statistics, and a variety of other trading metrics.”

“For Bitcoin to experience a robust price rally, an alignment of three factors (green areas) is required: Market sensitivity:

- Bitcoin’s correlation with macroeconomic and on-chain activities.

- Network activity: growth and liquidity of the network.

- Risk-off signal: a risk indicator at 0, suggesting a diminished likelihood of capitulation.”

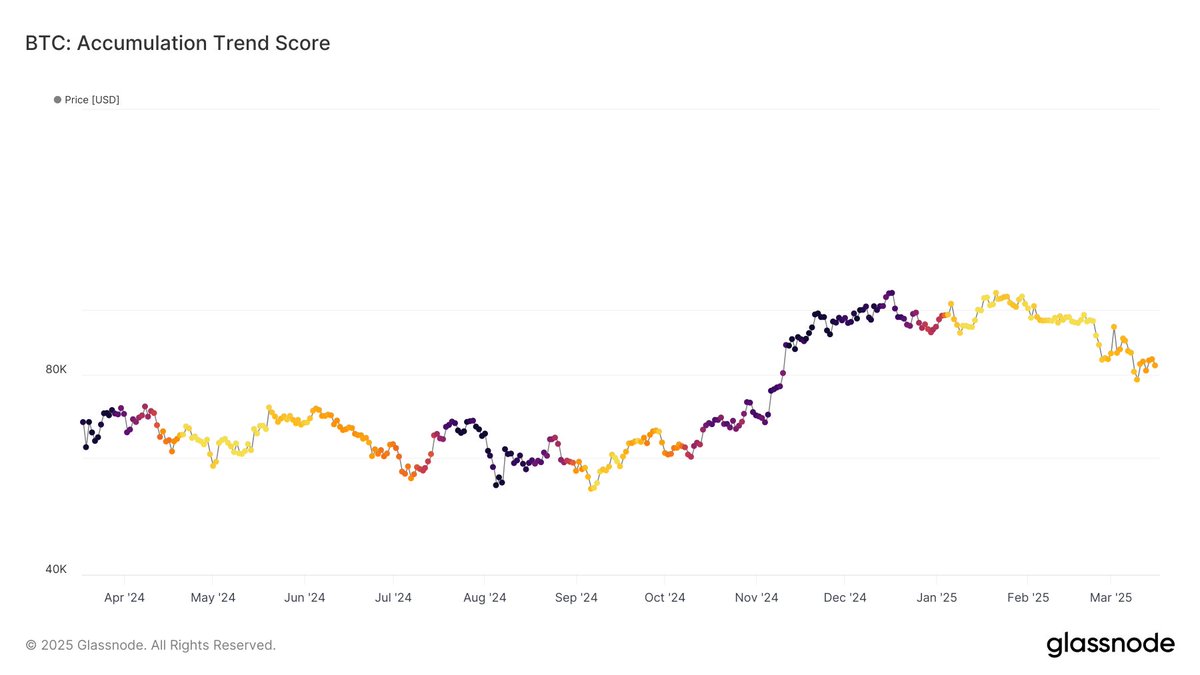

According to Allemann and Happel from Glassnode, another important metric suggests that Bitcoin accumulation is beginning to manifest as a market trend.

“Since March 11th, Bitcoin’s Accumulation Trend Score has crossed above 0.1, indicating some buying activity during the recent downtrend. While distribution remains prevalent, this shift hints at the early stages of accumulation.”

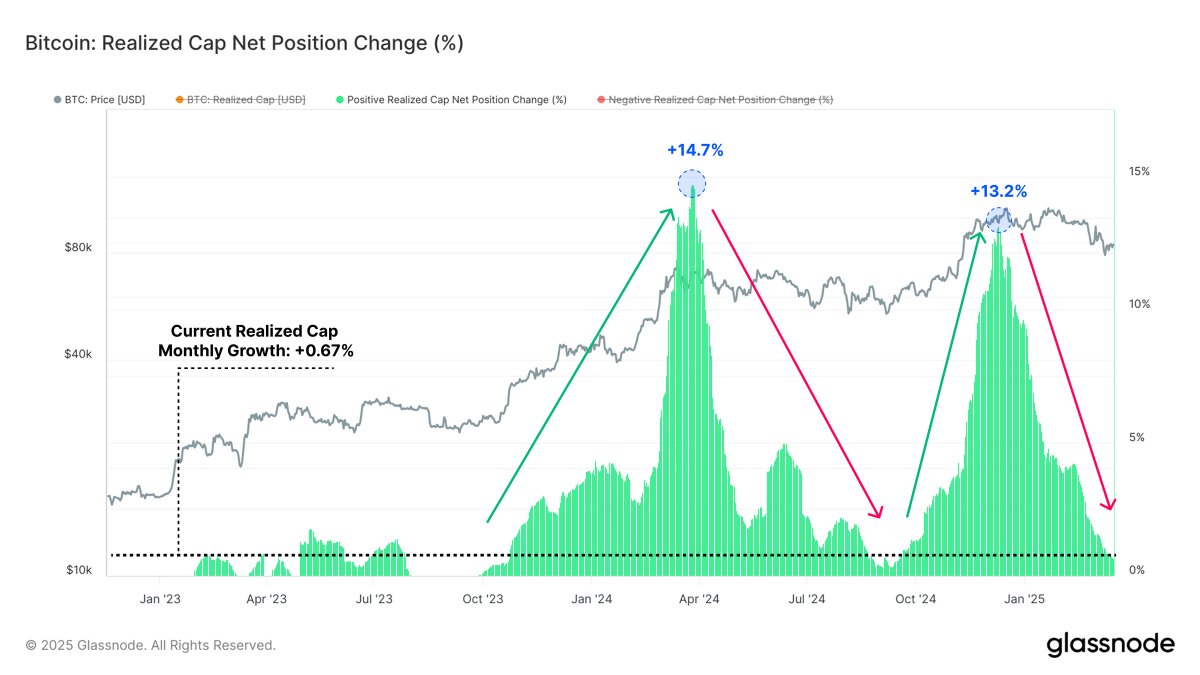

Glassnode further notes that Bitcoin’s realized cap net position change indicates that profit-taking and capital inflows are slowing.

The realized cap net position change captures the capital inflows and outflows of an asset, with positive values signifying accumulation.

“The Bitcoin market is continuing to adjust to its new price ranges following a -30% correction. Liquidity conditions are also tightening in both on-chain and futures markets.”

From Glassnode’s analysis, it appears that Bitcoin’s realized cap net position change has increased by 0.67%, which may indicate a market recovery in the current context.

As of this writing, Bitcoin is trading at $86,272, reflecting a 3.6% increase over the last 24 hours.

Follow us on X, Facebook and Telegram

Stay Updated – Subscribe to receive email alerts directly in your inbox

Check Price Trends

Explore The Daily Hodl Mix

Disclaimer: The views expressed at The Daily Hodl are not investment advice. Investors should conduct their own analysis before making any high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please be aware that your transfers and trades are at your own risk, and any losses incurred will be your responsibility. The Daily Hodl does not endorse the buying or selling of any cryptocurrencies or digital assets, nor does it provide investment advice. Please note that The Daily Hodl engages in affiliate marketing.

Generated Image: Midjourney